How Do You Know do You Have Weak Currency?

Weak currency is defined by the currency strength meter with low values on the graph. If the currency is strong it will show you high values on the graph.

The strenght of the currency is determined by few factors and you will know the currency is strong when:

- you see currency strength meter is showing currency strength rising

- currency pair price of certain currency against any other currency is rising in value

- you see GDP and interest rate of currency is rising in value

- you can buy more foreign currencies than before

- goods in another country looks cheap

Here is a more detailed explanation of each of the above listed points.

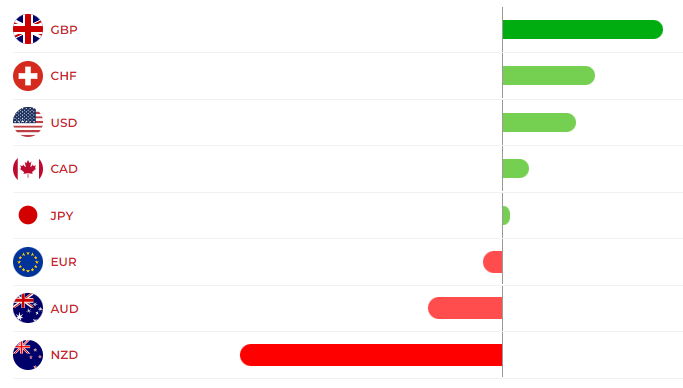

Weak Currency is Shown With Currency Strength Meter

Lets take U.S. dollar for example.

What you can see in the image above is that U.S. dollar strength is close to the top. That means the U.S. dollar is at the moment one of the strongest currency compared to others on the image.

The currency strength meter has taken the current price and compared it to the previous period. The result shows that the U.S. dollar strength has increased compared to previous price.

And when the U.S. dollar is checked against other major currencies the results are positive for USD.

Currency Pair Price of U.S. Dollar Against Any Other Currency is Rising in Value

In this case I will show you how the market looks when the U.S. dollar is rising in value against other currencies.

What you can see here is that the U.S. dollar is strong against other 6 currencies.

The chart shows you on the left side U.S. dollar as a quote currency. And the price of the currency pairs where the U.S. dollar is a quote currency will fall down if the U.S. dollar is strong.

This is like this because for example EURUSD pairs will decline in value when the U.S. dollar is strong. That means EUR will lose its value and will become weaker. So, the price of EUR against the dollar will decline.

On the right side you have the U.S. dollar as a base currency. And the price of a currency pair where the U.S. dollar is a base currency will rise in value if the U.S. dollar is stronger.

The price will rise because when you have a USDCAD pair that means USD will become stronger and CAD will lose its value and will decline.

Do not make trading mistake using currency strength meter where you trade strong weak currency against weak currency.

Weak Currency do Not Have GDP and Interest Rate Rising in Value

Here I will use an example when the GDP of the U.S. is rising so you can see how the news about the GDP affects the U.S. dollar. And that is when the GDP rises the U.S. dollar strength will increase.

The chart above shows you how the price of EURUSD currency pair is rising and declining in value. That means EUR is losing strength and U.S: dollar is gaining in strength.

Because of positive GDP news for USD the dollar strength rises.

Weak Currency Strength and Interest Rates Impact

In this case you can see when interest rates of U.S. dollar declines which means U.S. dollar is losing the strength. The rate has declined from 1.75 to 1.25.

The chart shows you that EUR is gaining strength against U.S. dollar and the price of EURUSD currency pair is rising.

Lower interest rates for U.S. dollar makes the dollar less attractive to investors so they move from U.S. dollar in more attractive currencies. Because investors will make less money with lower interest rates.

With money going outside of U.S.A. the dollar becomes weak. And that weaknes is visible as the EURUSD pair price is rising.

Conclusion

To know if currency is weak or strong you can simply use the currency strength meter.

Currency strength meter will show you the strength of a certain currency where all above factors are included. That way you do not need to calculate on your own all factors in the equation to get the strength of a currency.